Excitement About Tax Planning Leigh

Table of ContentsThe 9-Minute Rule for Tax Planning LeighA Biased View of Tax Planning LeighThings about Tax Planning LeighLittle Known Questions About Tax Planning Leigh.Tax Planning Leigh - An Overview

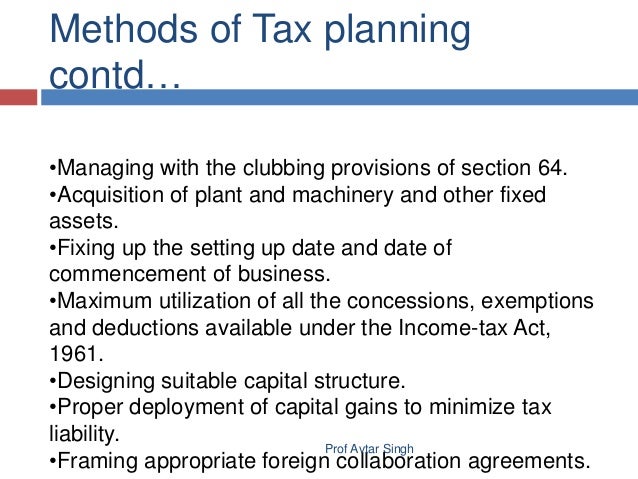

Whether or not a business owner enlists the help of an outdoors professional, she or he ought to comprehend the fundamental stipulations of the tax code. BASIC LOCATIONS OF TAX PLANNINGThere are numerous general locations of tax obligation planning that put on all sorts of small businesses. These areas consist of the choice of bookkeeping and also inventory-valuation methods, the timing of tools acquisitions, the dispersing of service income amongst member of the family, as well as the choice of tax-favored advantage plans as well as investments.The selection of accounting technique is a problem in tax obligation planning, as it can affect the amount of taxes owed by a local business in a given year. Bookkeeping records prepared making use of the money basis identify revenue and costs according to real-time capital. Income is tape-recorded upon receipt of funds, instead of based upon when it is really gained, and also expenditures are recorded as they are paid, as opposed to as they are really sustained.

Fascination About Tax Planning Leigh

Under this system, income is videotaped when it is gained, as opposed to when payment is obtained, and also expenditures recorded when they are incurred, as opposed to when repayment is made. tax planning leigh. The major benefit of the amassing method is that it gives an extra exact image of just how a business is performing over the lasting than the cash technique.

The technique a little service picks for supply assessment can also lead to substantial tax financial savings. Supply evaluation is very important because organizations are required to decrease the amount they deduct for supply acquisitions throughout a year by the amount remaining in supply at the end of the year.

The 9-Minute Rule for Tax Planning Leigh

In this method, FIFO values the staying stock at the most current price, while LIFO values the continuing to be inventory at the earliest price paid that year. LIFO is normally the liked inventory evaluation approach during times of rising prices. It positions a reduced value on the continuing to be supply and a greater worth on the expense of goods marketed, pop over here therefore decreasing revenue and tax obligations.

Earnings paid to youngsters under the age of 18 are not subject to FICA (Social Safety and Medicare) tax obligations. 65 percent of the initial $94,200 of a staff member's income for FICA tax obligations.

Self-employed individuals are required to pay both the employer as well as worker parts of the FICA tax obligation. The FICA tax obligations are waived when the staff member is a dependent kid of the tiny company owner, saving the youngster and also the parent 7. 65 percent each. Furthermore, the kid's salaries are still thought about a tax insurance deductible overhead for the parentthus decreasing the moms and dad's gross income.

Tax Planning Leigh Things To Know Before You Get This

Some service owners are able visit to even more decrease their tax obligation problem by paying salaries to their spouse. If these salaries bring the company owner's web revenue listed below $94,200 the limit for FICA taxesthen they may decrease the self-employment tax obligation owed by local business owner. It is necessary to note, nevertheless, that the kid or spouse must actually benefit business and also that the salaries need to be practical for the job done.

No special taxes are enforced other than for the self-employment tax, which calls for all self-employed individuals to pay both the company and also employee sections of the FICA tax, for a total amount of 15. 3 percent. Considering that they do not obtain a common income, the owners of sole proprietorships and also collaborations are not needed to hold back earnings taxes on their own.

It is crucial that the amount of tax paid in quarterly installments equivalent either the complete quantity owed during the previous year or 90 percent of their overall current tax liability. Or else, the IRS may charge interest as well as enforce a stiff penalty for underpayment of approximated tax obligations. Given that the Internal Revenue Service determines the amount owed quarterly, a big lump-sum settlement in the fourth quarter will not make it possible for a taxpayer to leave penalties.

Not known Incorrect Statements About Tax Planning Leigh

This results in a possible tax planning approach for an independent person that falls behind in his or her estimated tax repayments. By having actually an utilized spouse enhance his or her withholding, the self-employed individual can make up for the deficiency and also stay clear of a penalty. The IRS has actually additionally been recognized to waive underpayment charges for individuals in unique scenarios.

Another possible tax obligation planning technique relates to collaborations that expect a loss. At the end of each tax obligation year, collaborations submit the informative Kind 1065 (Partnership Statement of Earnings) with the Internal Revenue Service, and also after that report the amount of income that accumulated to each partner on Arrange K1. This income can be separated in any kind of variety of ways, depending upon the nature of the collaboration arrangement.

Tax preparation techniques for C companies are various from those used for single proprietorships and also collaborations (tax planning leigh). This is because profits gained by C firms accumulate to the firm as opposed to to the individual proprietors, or investors. A company is a different, taxable entity under the law, as well as different business tax prices use based Full Article on the amount of internet earnings gotten.